2026 IT Budgets Grow But Projects Take the Biggest Share

As spending expectations rise, the composition of IT budgets matters more than the headline number. The Winter 2026 Macro Views Survey Findings show organizations doubling down on projects and cloud expansion, while labor remains the primary lever for cost control. To ground this in context, ETR surveyed 1,746 technology leaders, including 285 from the Fortune 500 and 421 from the Global 2000.

IT budgets are growing where leaders can fund execution and scale core platforms. They are not growing where costs are tied to labor-heavy delivery models or fragmented vendor stacks.

Projects Reassert As the Primary Growth Engine

When budgets expand, the instinct is to look for a shopping spree. That is not what the data shows.

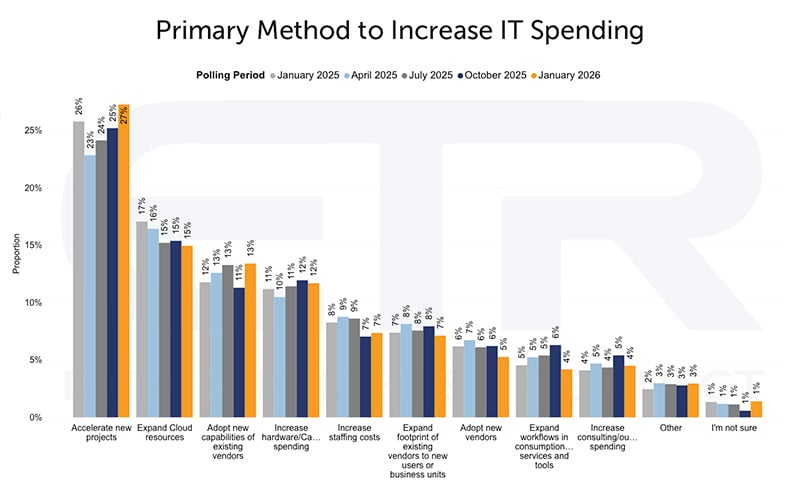

In this survey, 74% of respondents plan to increase IT spending in 2026. But the biggest driver of those increases is not a wave of vendor switching or a surge in experimental tooling. It is execution.

New projects account for 27% of spending increases, making them the top growth driver.

That 27% figure signals something important. After a prolonged period of delay cycles, enterprises are moving from planning to delivery. In practical terms, this tends to show up as:

-

Modernization initiatives that were approved but staggered

-

Platform consolidation tied to measurable outcomes

-

Security and resilience work that no longer fits in the “nice-to-have” bucket

-

Data and AI programs that have to prove value beyond pilots

It also shows up in what is not driving spend. Only 5% say increased spending will be primarily driven by adopting new vendors. That is a clear message. If you want budget, you have to attach to what is already funded, already underway, and already defensible.

Cloud Expansion Continues But Without Euphoria

Cloud remains the second-largest driver of budget growth, but the emotional tone has changed.

Among organizations increasing spend, cloud expansion is the No. 2 driver at 15%. That is still meaningful, but it is not a “cloud at any cost” signal. It is a “cloud, with scrutiny” signal.

On the spending side, respondents point to 7.9% spend-weighted mean growth for IaaS and PaaS, but that is down 1.6 percentage points from the 9.5% high in January 2025. And 21% anticipate either no change or reduced cloud spending in 2026 compared to 2025.

Two forces are shaping this “cloud without euphoria” moment.

Cloud Is Now Foundational

For many enterprises, cloud is no longer a bold transformation decision. It is an operating model. That means growth persists, but it is governed like any other core utility. Utilization, commitments, and measurable business value now sit at the center of the conversation.

Pricing Inflation Is Doing More of the Work

Then there is the piece many teams feel in renewals: pricing.

ETR’s data shows cloud growth is being helped by 2.6% pricing inflation, and 58% of respondents report vendors have raised prices. The deeper pricing cut reinforces that cloud price increases have been persistent and relatively stable over time.

What this means: cloud is still a budget winner, but a more mature one. Growth is steadier, and cost governance is no longer optional. If you are selling into cloud programs, “we reduce spend” and “we improve utilization” increasingly sit alongside “we help you scale.”

Labor and Vendors Absorb the Cuts

Here is the part that deserves empathy, not just analysis.

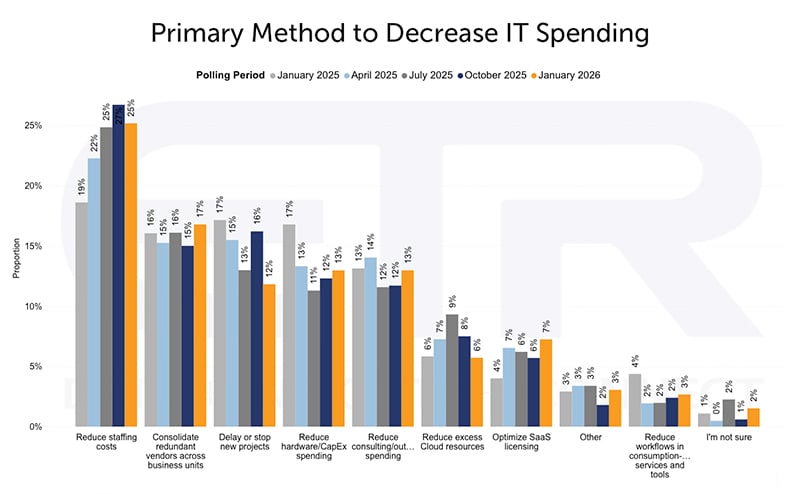

Only 15% of respondents plan to decrease IT spending in 2026, so broad-based austerity is not the story. But among that minority, the actions are clear and consistent.

-

Reducing staffing costs (25%) is the top method for decreasing IT spend

-

Vendor consolidation (17%) is next

-

Delaying or stopping new projects has fallen to 12%, which is a notable signal that even cost cutters are trying to protect execution

Put differently: when budgets tighten, enterprises are looking first at labor-heavy cost structures and redundant tooling, not the initiatives they believe must ship.

This is where the “fewer, larger winners” dynamic comes from. Consolidation rarely means nobody wins. It typically means the most embedded platforms become more embedded, and everything else must justify its existence with hard outcomes.

What the Budget Mix Signals for 2026 Planning

When you put the pieces together, the message is consistent.

-

Growth goes to execution. Projects are the leading growth engine, and adoption of brand-new vendors is limited

-

Cloud grows, but with governance. Expansion continues, but not with a blank-check mindset, and price inflation is part of the story

-

Cost actions hit labor and long-tail vendors. Enterprises are optimizing operating models and reducing tool overlap

For technology leaders, this becomes a practical planning advantage. Pressure-test your roadmap using a simple filter.

Will this initiative directly support delivery, modernization, or a core platform standard?

If yes, it is closer to the budget green zone. If not, expect deeper justification requirements.

Conclusion and Takeaways

Enterprise budgets are expanding, but not indiscriminately. The winners will be tied to mission-critical projects and platforms, while discretionary tools and labor-heavy models face ongoing scrutiny.

Three takeaways to carry into 2026:

Prioritize projects with measurable execution milestones. That is where spend is concentrating. Treat cloud as an operational discipline, not a strategy slogan. Budget growth may be steady, but value capture depends on governance. Assume consolidation will continue. “Fewer, larger winners” dynamics are reinforced by both cost actions and procurement reality.

Get the Winter 2026 Macro Views Summary. Use the Winter 2026 Macro Views Findings Report as your baseline for 2026 planning and pressure-test assumptions against where technology leaders are most willing to fund execution versus experimentation. Complete the form below to have the summary emailed to you and to gain access to the findings report.

Straight from Technology Leaders

We eliminate bias and increase speed-to-market by cutting out the middleman and going straight to the voice of the customer