Atlassian is the de facto Standard for Agile Development

As a follow-up to our recent Drill Down Survey and report, ETR convened a moderated group discussion with four technology leaders from the ETR Community to share their experiences and impressions of Atlassian. The panel featured a diverse cross-section of enterprise technology professionals, including:

- the Head of Content Analytics Engineering at a global pharmaceutical enterprise

- the Global Head of Data Analytics for a global financial services firm

- the VP of Engineering for a global software development company

- the VP of Technology & Business Development for a large food and beverage manufacturer

Panelists discuss their plans to increase Atlassian spend while debating the merits of transitioning from self-managed data centers to cloud services, citing integration complexity, compliance requirements, and existing infrastructure investments as considerations. They break down their usage of Atlassian’s product portfolio across both instances and discuss how they mitigated spiking data center costs with long-term licensing agreements. Looking ahead, the group is cautiously optimistic about AI—expecting it to deliver operational efficiency and role evolution rather than outright job displacement—and many are already investing in these tools through incremental budget increases or resource reallocation.

Vendors Mentioned: Asana, Atlassian (Bitbucket, Confluence, Jira Service Desk, Jira Work Management, Opsgenie, Rovo), CrowdStrike, Microsoft, Notion, Perforce, ServiceNow

Key Takeaways

- Spending Remains Strong, Driven by Headcount: All four panelists report stable or increasing Atlassian budgets—some expecting spending to potentially double—primarily due to ongoing growth in development, QA, and other technical roles.

- Data Center vs. Cloud Still Debated: While Atlassian’s pricing strategies push customers toward SaaS, many organizations remain cautious about fully migrating, citing compliance requirements, integration complexities, and existing infrastructure investments.

- Price Hikes Mitigated Through Long-Term Deals: Recent increases in data center prices have not prompted major defections from Atlassian. Most panelists have navigated potential cost spikes by securing multi-year agreements or accepting incremental renewals.

- AI’s Rising Influence on Efficiency, Not Job Cuts: Although Atlassian Rovo is still in early evaluation, panelists foresee AI boosting productivity and reshaping roles rather than eliminating them. Firms budget for AI through incremental spending or reallocation, hoping to unlock rapid returns without overcommitting.

Panel Summary

Spend and Growth Trajectory. Atlassian spend is resilient in an unpredictable market. All four panelists report steady or increasing budgets, ranging from $200K (on Jira alone–a $50k year-year-over increase for the product) to over USD $1M (across all Atlassian products), skewing towards larger dollar amounts. Spending growth is largely linked to headcount growth among developers, QA, and other technical teams. “What’s driving the increase (for Jira) is the incremental headcount that [are currently] using, the tool that we’re licensing,” reports one head of IT. “We are also looking at some [new] incremental products from Atlassian, that if we were to [adopt] next year, could drive the amount that we spend up quite considerably—double it or more.” Among those organizations spending around $1M or more, the pharmaceutical firm expects future spend to be mostly flat, with only minor seat fluctuations; the software firm anticipates further spend tied to additional headcount while remaining open to retooling when Atlassian retires Opsgenie in 2027.

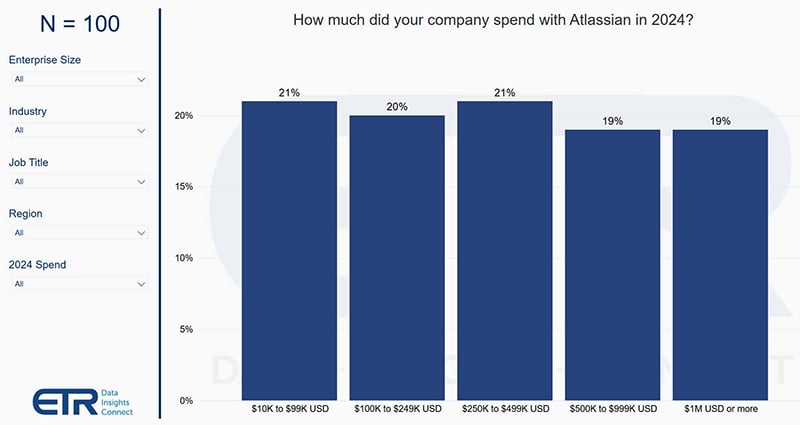

ETR Data: Survey respondents reported balanced spend on Atlassian in 2024 with a relatively even distribution across intervals (~20% each), ranging from relatively modest usage ($10K-$99K) to very large investments ($1M+). The data skews slightly towards lower spending intervals, though 38% of respondents indicated plans to spend $500K or more.

Although Opsgenie represents a smaller portion of their overall Atlassian budget, its planned retirement in 2027 has prompted one technical lead to reconsider their company’s options for incident management. “It’s possible we’ll stay with Atlassian...or it’s possible we won’t, so that might be some reduction. I don’t know if there’s a clear successor…We liked Opsgenie for what we used it for, but we won’t be able to use it past 2027. We have enough lead time, but we just became aware of this, so it’s something we’ll be working on over the next few weeks and months.”

Within the financial services industry, our panelist sees market saturation and stable headcount limiting further adoption. “There could be some one-time tactical developments. Even in the case of a divestiture, it doesn’t necessarily mean a cliff drop. Sometimes there is actually a need to set aside separate segments, which might temporarily lead to additional license needs if you don’t segregate those. But those would be more one-time events.” Another describes how usage modulates to fit business needs but is generally flat. “I would say there’s probably +/-5% fluctuation in terms of the number of seats for this product at any given time. In one cycle, we decide to invest less into third parties and more into internal development, then we’ll flip, and it goes back and forth. Some teams decide to adopt it, while some decide to sunset it.”

ETR Data: The model above shows how most respondents (82%) expect their purchase of Jira (Cloud) licenses to remain steady or increase modestly, by +1% to +9%. Not pictured, Confluence (Cloud) registers similar patterns. The full license change breakdown for tracked Cloud products is available in the full data set on the ETR Platform.

Product-Specific Feedback. Atlassian products continue to be central to operations across diverse industries; one panelist, who leads a technical operations team calls Jira the “the backbone of managing all the work that our company has to do.” The head of IT at a food manufacturer with 4,800 employees describes Jira as critical for service desk operations, in addition to “a whole series of reporting around ticketing and ticket priority.” Jira also remains ubiquitous across agile development, as the pharmaceuticals data engineer explained: “My favorite part of Atlassian, especially Jira, is that it’s been around for so long that it’s sort of the de facto standard for agile software development tools. It’s almost always there, and I don’t have to explain the need for it.”

The Global Head of Data Analytics at a financials institution who regularly uses Jira, especially praises Confluence specifically. “I have the least amount of gripes with Confluence because it’s very easy to use, very easy for collaboration, and very easy to put things in a documented form, share, and collaborate.” They do have reservations about Jira’s interface and wish Bitbucket had “much better search capabilities, and a much better repo analysis and a different branch analysis.”

ETR Data: The tables above show respondents’ expected usage for Atlassian products across both its Cloud and Data Center instances. In both cases, Jira and Confluence are the most-used products by a margin.

Despite these concerns, Jira is still viewed favorably relative to competitors like ServiceNow: “If I do a comparison and contrast between Jira and ServiceNow, to me, Jira would win 100% of the time. It’s relatively low cost. It’s perfectly capable of achieving all of the minimum tasks that are needed to drive value out of this type of product. I like it, and it’s the right price. It has the right level of support. It’s easy enough for users. It doesn’t require a ton of people to administer it or set it up.” However, with growing pressure from Notion, Asana, and ServiceNow, one panelist advises Atlassian to focus on its overall user experience, where newer companies have raised the bar. “I think the user experience, they are a legacy product, and if you look at the more modern tools, the user experience—the UI, the usage of it, the UX of it—could be improved.”

Data Center vs. Cloud. Organizations continue to weigh the shift from traditional self-managed data center solutions to cloud-based services, Atlassian among them. Many remain cautious about fully migrating to the cloud. “We are legacy, what you could describe as hybrid multi-cloud,” says the SVP in finance. “We are not opposed to actually adopting Atlassian Cloud down the road, but there are some hurdles. First of all, we have basically an integration-based in our development tool chain. We are not like Atlassian end-to-end for CI/CD pipeline. Atlassian is basically building blocks of our tool chain, so that transition to the SaaS will have to address some of this integration complexity.” They point to Atlassian’s earlier operational and reliability issues, the need for rigorous compliance assessments, and sunk cost within their existing infrastructure. “For business software, that was a much more straightforward decision. Here, because it’s a development delivery tool, a part of the tool chain, the decision is not straightforward. We [presently] don’t see a strong imperative towards that transition into SaaS, considering our existing deployment footprint, support structure around that, and integration-based tool chain.”

ETR Data: (L) Fifty-two percent (52%) of respondents purchase only Atlassian Cloud products, while 31% purchase both Cloud and Data Center products. Only 17% of respondents purchase only Data Center products. (R) Despite the skew towards purchasing Cloud instances, spending is nearly split between the two, with 53% of spend in the Cloud.

Another panelist, while satisfied with the service, has moved from cloud-based Jira deployment back to a self-managed system, motivated by compliance requirements. “Our Jira instance [with] the largest user base actually started in the cloud, but because of industry compliance, we decided to move from the cloud to self-managed, self-hosted. It’s probably been more of a challenge from a technical point of view to have to manage it ourselves.”

One Head of IT has a historical preference for on-premises solutions—"I do like to run on-prem products if I can, so that I can control them; our performance expectations are pretty high”—while admitting to a gradual transition towards cloud-based systems driven by vendor development and ease-of-maintenance. “As we expand our footprint, it’s tending to go more to the cloud-based version, just because that seems to be where more of the feature capability is coming from.” Broadly, all panelists cite stability and previous infrastructure investments as reasons for continuing on-premises or in self-managed cloud. “It’s operationally stable, the occasional CrowdStrike bad deployment aside. ‘If it ain’t broke, don’t fix it.’”

Atlassian’s recent price hikes on its data center products also surfaced in discussion. One panelist indicated their organization anticipated these changes and secured long-term agreements to prevent abrupt cost fluctuations. Another is similarly leveraging multi-year agreements. “Unless they’re willing to fight a legal battle with us, we feel pretty comfortable where we are.” A third panelist views Atlassian’s pricing as part of an industry-wide effort to accelerate cloud adoption. “It’s not atypical in the ISV space to play that kind of game, to jack up prices on legacy on-prem and incentivize the transition to cloud,” they say, though this does not deter them. “It’s rarely a factor in our rationalization, so it kind of all lines up eventually to mutual satisfaction. If we have to absorb the price uptick in the next renewal, for the time being, that’s something we could live with.”

Rovo and AI Impacts. Most of our panelists have yet to formally evaluate Atlassian Rovo, though one anticipates playing it off ServiceNow and Microsoft Copilot for negotiation leverage. “The practical route for us, the way we see it is, rather than attempt to build an overarching enterprise knowledge graph, for the time being, we’ll let these ecosystems prove their mettle, to show what they’re capable of. Who is to say that Atlassian has the best vantage point to really offer a productivity boost, and this kind of a quantitative leap in intelligence?”

ETR Data: Organizational plans for Rovo vary among purchasers of Atlassian Cloud. Ten percent (10%) are currently utilizing the AI offering (with no plans to replace), and another quarter have plans to evaluate or adopt. On the other hand, 42% have no plans to evaluate or use, and 8% have evaluated but are not currently using.

Navigating a surge of artificial intelligence tools, our guests are budgeting for AI in various ways. One blends incremental year-over-year budget increases for digital initiatives—roughly 10% annually—with savings reallocated from existing operations. To manage risks, they primarily leverage third-party solutions, cautious not to overcommit. “The model that you build today will be the worst model that you will have, because they keep improving at a rapid pace.” Another explained that their company does not allocate specific budgets to AI but evaluates it as one potential solution among many. “We don’t have water pipe budgets,” he analogized, emphasizing that AI is simply a tool to achieve broader business objective.

A third panelist, however, says that their firm has clearly defined AI roles, including a Chief AI Officer, though funding still stems from general IT expenditures. The organization expects rapid returns from AI investments, often reallocating resources to support promising AI initiatives. “With AI we essentially expect almost immediate payback, so almost like a net zero kind of change in terms of spend. Any spend we have, we expect to pay back almost immediately, whether it’s OPEX or payback savings.” ROI for AI tools remains subjective and imprecise; for now, organizations are reprioritizing investments and sacrificing short-term gains to build long-term AI capabilities.

Broadly, the panel anticipates AI will influence hiring primarily through operational efficiencies and job evolution rather than outright job elimination; one panelist reports in particular a decreased dependency on outsourced night shifts, with AI handling basic frontline customer interactions. “The AI is perfectly as good as somebody who doesn’t have any actual functional knowledge to solve a problem, and is really just answering and routing a phone call. In areas like that, I think there’s probably already a headcount impact occurring out there.”

Rather than disappearing, roles will evolve, prompting workers to adapt and develop new skills. “If I take a look a couple of years from now when AI has developed more, and we’re talking about systems that are able to generate code or generate scripts and evaluate those things on their own, I think for sure there’s going to be jobs that change. I won’t say ‘lost.’ Everyone says technology causes everyone to lose their jobs, but we’re all still here and employed a thousand years later.” Some expect it will allow them to reduce dependency on outsourcing partners; for one, a significant portion of the company’s budget is allocated to BPO and ITO, with management pressuring suppliers to optimize their services. “[They’ll] have to find a way of delivering their services with fewer seats.”

Closing Remarks

Atlassian continues to demonstrate notable market resilience, buoyed by widespread adoption across technical teams and ongoing headcount expansion. These tools remain core to many organizations’ development and operational workflows, with budgets still trending upward. However, uncertainty around on-premises versus cloud deployments persists, largely due to compliance hurdles, integration complexities, and Atlassian’s pricing strategies, which encourage migration to SaaS. Despite these obstacles, a gradual shift to cloud appears likely in the long run—especially as Atlassian refines its offerings to align with modern requirements.

Meanwhile, the rise of AI-driven capabilities promises significant efficiency gains, suggesting a future where workforce roles evolve rather than vanish outright. Yet this same disruption underscores the growing competitive pressure Atlassian faces from newer platforms such as Notion, Asana, and ServiceNow—solutions often commended for delivering more streamlined user experiences. To maintain its standing as a go-to enterprise solution, Atlassian must address compliance concerns, strengthen its user interface, and clearly differentiate its next-generation portfolio. By balancing these strategic imperatives, the company can leverage its entrenched position to thrive in an environment characterized by accelerating cloud adoption, burgeoning AI innovation, and increasing demands for a seamless user experience.

Straight from Technology Leaders

We eliminate bias and increase speed-to-market by cutting out the middleman and going straight to the voice of the customer