How Tech Leaders Navigate Rising Geopolitical Risk

2025 has been a year defined by volatility, and enterprise technology leaders have had to navigate pressures that go well beyond traditional IT planning. Shifting trade policies, tariff swings, election transitions, and widening geopolitical tension have driven an environment where even well structured technology roadmaps needed midyear rewrites. At the same time, IT budget expectations have cooled. In January, leaders projected +5.3% spend growth, the highest since 2022, but by October that figure had eroded to +3.2% as new risks reshaped decision making.

In this climate, a central question has emerged. How have enterprise organizations adapted their IT, security, and vendor strategies in response to escalating geopolitical risk, and what playbook is now guiding technology decisions headed into 2026?

The Macro Views Survey data and the coordinating feedback panels provide a clear narrative. Geopolitical risk is no longer a background concern. It is now a direct input into architecture choices, supplier selection, cybersecurity programs, and investment prioritization.

From Caution to Action: Adjustments Across 2025

-

January: Minimal concern for geopolitical disruption

Early in the year, organizations were not yet treating geopolitics as a primary driver of IT decision making. January spending optimism was notably higher, with cloud expansion and project acceleration leading the way. Geopolitical risk was present, but it did not dictate strategic posture.

-

April: A sharp inflection point

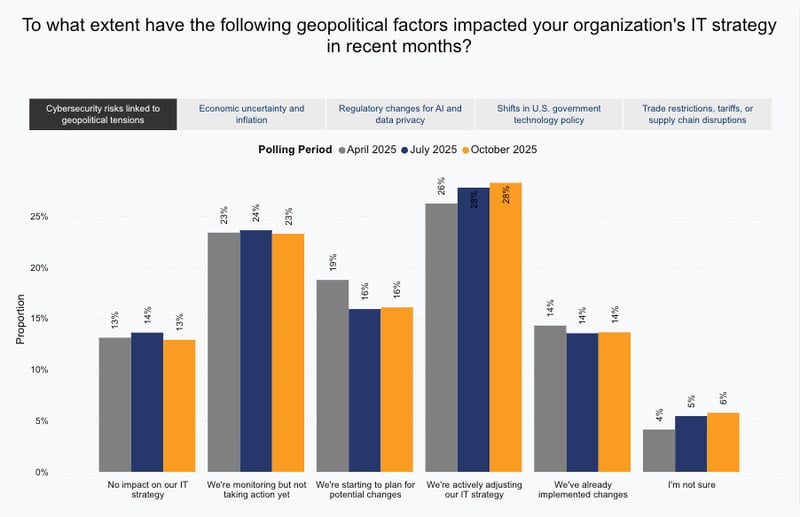

By April, geopolitical cybersecurity concerns became unavoidable. According to the April Macro Views findings, 40% of respondents were adjusting IT strategies due to cybersecurity risks linked to geopolitical tensions. This rise occurred just as reciprocal tariff announcements and new policy signals came into view.

Industrials and IT and TelCo firms reacted most strongly, with shifts across vendor portfolios and greater interest in multi supplier strategies. One panelist summarized the need for scenario flexibility when he explained, “We have a high tariff plan, and we have a no tariff plan, and then we have a couple of plans for ranges in the middle.”

-

July: Trade and supply chain disruption intensifies

By July, the number of organizations adjusting or planning changes due to trade restrictions and supply chain pressures climbed to 42%, up from 33% in April. The July findings also show that delaying hardware purchases jumped from 33% to 40%, making it the most common tactical response. Vendor diversification followed closely at 38%.

ETR analysts noted the shift succinctly: trade policy became the fastest growing driver of IT strategy adjustments between April and July.

October Reality Check: Geopolitical Impact Becomes Structural

By October, geopolitical and economic pressures were no longer episodic. They had become embedded in IT strategy.

The Fall Macro Views Survey data shows:

- 33% of all respondents, and 40% of Global 2000 firms, reported direct impact on IT strategy from tariffs, trade shifts, or supply chain disruption

- The top three tactical responses were:

- Diversifying vendor portfolios (42%)

- Switching to suppliers with lower geopolitical risk (41%)

- Delaying hardware purchases (38%)

- Inflation (+2.7%) and U.S. government tech policy (+2.3%) were the fastest rising drivers of IT change

This aligns with the panel’s assessment that operational flexibility is now a permanent requirement. As geopolitical risk intensified, balancing predictability with agility became essential.

Cybersecurity: Protected, but Under Pressure

If there is one area where budgets remain insulated, it is cybersecurity. However, insulation does not mean stability. Cyber teams are being asked to secure more with fewer resources, consolidate tooling, and provide greater cross functional value.

One panelist, a Chief Information Officer, stated, “I would say for us, cyber is also pretty sacrosanct. I think the challenge that you have anytime you look at consolidating vendors is that often takes additional investment, which you know is what you’re trying to reduce. You really have to balance those two aspects. Is the ROI really there, to be able to invest what you need to invest to consolidate?"

Another panelist, a VP of IT Security added, “I agree completely—or at least from what we’ve seen or experienced—that cyber is generally protected, but cyber is also asked to do more now. On many cases, from a just product rationalization or tool rationalization, the focus has shifted a little bit to seeing how we can leverage our tooling within cybersecurity more effectively, whether it be through asset management, software metering, or log management. How can we use that data to enrich other areas of IT versus just keeping it completely isolated? That’s an area, and one of the drivers is cost optimization.”

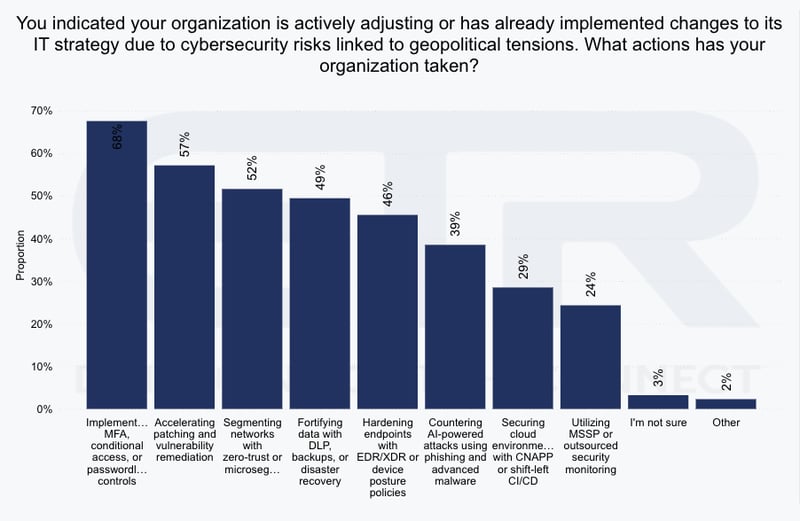

The October findings reinforce this pressure. Among organizations adjusting IT strategy due to geopolitical cybersecurity risks:

- 68% enhanced identity security

- 57% accelerated patching and vulnerability management

- Zero trust, DLP, and endpoint security followed at 52 to 46%

Panelists echoed the need for efficiency and impact. Security data is increasingly being repurposed for asset management, compliance, and broader IT visibility.

CrowdStrike, Cisco, and CyberArk remain top cited vendors aligned with positive spending momentum in 2025.

Building the New Playbook for Resilient Tech Strategy

The year tells a clear story of evolution.

Q1: Optimism and expansion – Priorities centered on growth, project acceleration, and cloud scale out.

Q2: Shock and adjustment – Tariffs, election transitions, and geopolitical cyber threats forced scenario planning and early defensive repositioning.

Q3: Strategic diversification – Vendor portfolios widened, hardware cycles slowed, and cloud adoption patterns shifted.

Q4: Risk institutionalization – Geopolitical factors became ongoing inputs to architecture, procurement, and governance.

Looking ahead, 2026 projections show expected spend growth of 4.0%. This is a modest improvement, but resilience has overtaken growth as the core priority.

To operate effectively in this new environment, technology leaders are doubling down on:

- Multi vendor flexibility rather than consolidation

- AI driven supply chain risk modeling

- Stricter data governance across regions and borders

- Balancing efficiency with geopolitical adaptability

This shift toward resilience is not a temporary response. It is a structural transformation in how enterprise IT planning works.

Closing Insight: From Global Instability to Enterprise Agility

The Macro Views Survey Findings make one conclusion unavoidable. In 2025, risk management became strategy. Organizations that once treated geopolitical events as external noise now consider them foundational to how they architect technology, secure systems, and choose vendors.

Heading into 2026, the most successful organizations will be those that embed geopolitical awareness into every layer of technology planning, from infrastructure decisions to AI governance.

Download the Fall 2025 Macro Views Survey Findings Summary

To dive deeper into the full dataset, trends, and vertical level insights: Fill out the form to download the Fall 2025 Macro Views Survey Findings Summary. You will also receive access to the full report and the findings webinar.

Straight from Technology Leaders

We eliminate bias and increase speed-to-market by cutting out the middleman and going straight to the voice of the customer