SailPoint has seen its Net Score trend positively for the fourth consecutive quarter, putting it ahead of comparable identity security platforms, but decreasing Adoptions and a longer-term, three-year decline in Net Score within the critical Global 2000 cut tempers our outlook on the company’s latest data set.

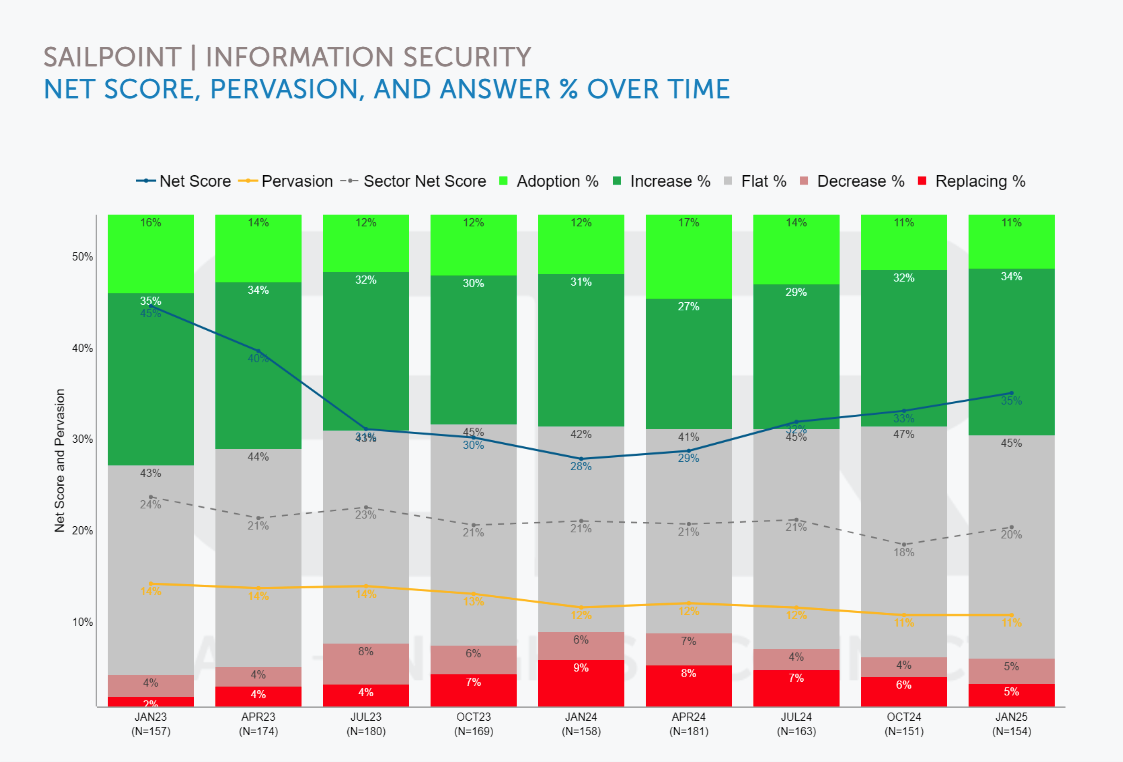

Within the Information Security sector, SailPoint had a Net Score of 35%, an increase of 6 percentage points since last April, and rising for the 4th consecutive survey to bounce off all-time lows of 28% in JAN24. Longer term, SailPoint’s Net Score remains well below 2022 levels that were above 50%. Meanwhile, the company maintains a relatively low Pervasion of 11% within the Information Security sector.

In its recently filed S-1 statement in January, SailPoint counted 25% of Global 2000 members as product users, equal to roughly one-sixth of the vendor’s entire customer base. In the JAN25 TSIS survey, Global 2000 respondents accounted for 37% of the vendor’s more than 150 unique end-user citations. Larger customers account for a disproportionate percentage of SailPoint’s recurring revenue, with its top 900 accounts totaling over three-quarters (76%) of ARR as of October 2024. Isolating Global 2000 accounts in our survey sample, we see that Net Score among this group has fallen considerably since 2022, coinciding with the year that the company was taken private.