Tech Leaders Weigh Priorities in 2025 Budget Shift

After a strong start in January, technology budget projections for 2025 have steadily cooled, reflecting a year marked by sharp adjustments, cautious optimism, and evolving priorities. ETR’s Macro Views Surveys from January, April, and July capture the uneven path enterprise IT is navigating.

From January’s Highs to Mid-Year Moderation

In January 2025, global IT spending growth was projected at +5.3% year-over-year, the highest estimate since July 2022. C-suite respondents were even more bullish, forecasting 6.1% growth.

By April, that figure had dropped to +3.4%, the steepest quarterly decline since ETR began tracking in 2020. Fortune 500 and Global 2000 organizations led the slowdown, projecting only 2.4% and 2.2% growth, respectively.

July brought a slight rebound to +3.6%, but optimism remains far below January levels. Large enterprises are still the most cautious — even after modest upward revisions, their budgets trail smaller firms and certain verticals like Energy/Utilities.

Where Budgets Are Expanding and Where They’re Not

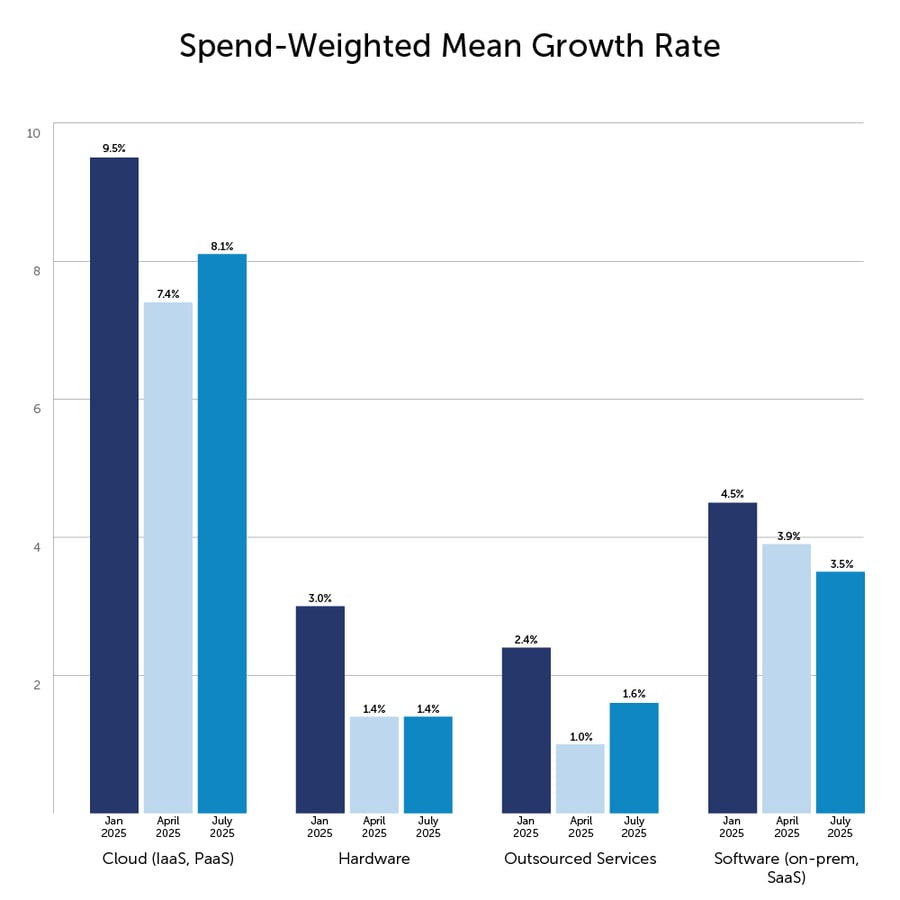

Despite the overall cooling trend, not all tech categories are experiencing the same fate:

- Cloud (IaaS, PaaS): The perennial growth leader, cloud spending is projected to rise +8.1% in 2025, recovering from April’s 7.5% but still below January’s 9.5%. About one-third of organizations plan to boost cloud budgets by 10% or more.

- Software (on-prem & SaaS): Growth has slowed to +3.5% in July, down from 4.5% in January. This is the only category to decline in two consecutive surveys.

- Hardware: Budgets are flat at +1.4% growth in July, half of January’s projection.

- Outsourced Services: After hitting a low of 1% growth in April, projections rebounded to +1.6% in July — still well below price increases for the category.

Pricing Pressures Are Persistent

Vendors continue to raise prices across all major categories. Over the first half of 2025:

- Hardware prices rose +3.8% in July, the steepest increase in more than a year.

- Software prices climbed +3.6%.

- Cloud pricing increased +2.7%.

- Outsourced services pricing rose +2.9%.

These increases are notable because in multiple categories, price growth is outpacing spending growth, creating additional budget strain.

How Organizations Are Adjusting

When cutting budgets, the most common lever remains reducing staffing costs (July: 20% of respondents), followed by consolidating redundant vendors and delaying new projects.

For those increasing spend, the top drivers are launching new projects and expanding cloud resources, although the latter has been trending down for four consecutive surveys.

Enterprise Size and Industry Divide

- Small and Midsize organizations maintain the highest growth expectations, while large enterprises continue to tighten budgets.

- By industry, Energy/Utilities stands out for its optimism, while Financials/Insurance saw further declines in April and July after a strong start in January.

The 2025 Budget Outlook

Three key themes stand out for technology leaders planning the rest of 2025:

- Growth is still positive, but selective. Budgets aren’t collapsing; they’re shifting toward priority areas like cloud, AI, and cybersecurity.

- Inflation in tech costs is real. Price hikes across categories mean flat budgets can still feel like cuts.

- Large organizations are in cautious mode. This gap in optimism between the Global 2000 and smaller firms could shape vendor strategies for the remainder of the year.

In short, 2025 is a year of recalibration. While the early-year exuberance has cooled, most organizations remain committed to growing IT investment but with sharper pencils and more deliberate priorities.

Want to see more of the July 2025 Macro Views Survey Findings? Complete this form to be emailed a link to the the findings summary, plus access to the full data report and findings webinar.

Straight from Technology Leaders

We eliminate bias and increase speed-to-market by cutting out the middleman and going straight to the voice of the customer